Free Advice For Picking RSI Divergence Trading

Wiki Article

Recommended Info For Deciding On An RSI Divergence Strategy

Let's begin by asking the obvious question and look into what RSI Divergence is and what trading indicators we can learn from it. The Divergence happens in your chart when price action and RSI indicator are out of the sync. Which mean, in a Downtrend market, Price makes a Lower low. However, the RSI indicator is able to make higher lows. The indicator might not be in agreement with the price, and a divergence occurs when it does not. Be aware of the market whenever the situation occurs. The bullish RSI and the bearish RSI divergence can be clearly observed in the chart. The price movement was actually reversed by both RSI Divergence signals. Now, let's talk about one last topic before move to the topic that is exciting. Follow the recommended trading platforms for more tips including forex backtester, forex backtester, automated trading software, backtesting strategies, automated trading software, divergence trading, RSI divergence, cryptocurrency trading, trading platform, cryptocurrency trading and more.

How Can You Analyse Rsi Divergence

We use RSI to determine trend reversals. Therefore, it is essential to recognize the correct one.

How To Identify Rsi The Presence Of A Divergence In Forex Trading

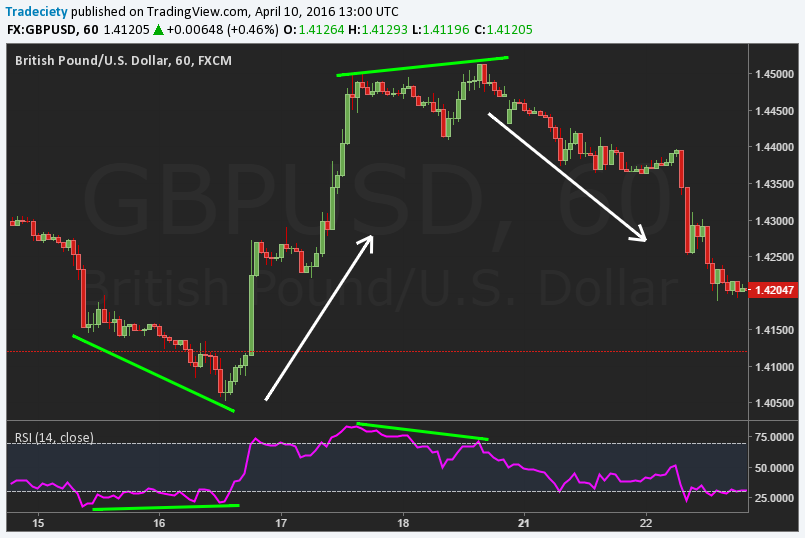

Both Price Action and RSI both hit higher highs in the initial upward trend. This is an indication that the trend has strength. However, at the end of the trend, Price forms higher highs. However, the RSI indicator has formed lower highs that indicate that there's something to watch in this chart. This is why to pay focus on the market. Both the indicator and the price action are out-of-synchrony, which indicates the presence of an RSI divergence. In this instance, the RSI divergence indicates an upward trend. Take a look below at the chart to see what occurred after the RSI Divergence. You can see that the RSI divergence is extremely precise in identifying trend reversals. However, the issue is: what is the best way to detect the trend reversal, right? Let's look at four trade entry methods that give greater chances of entry when used in conjunction with RSI divergence. Check out the most popular crypto trading for more recommendations including divergence trading, forex trading, cryptocurrency trading, forex backtesting software free, trading platforms, automated trading bot, automated forex trading, automated trading bot, forex backtesting software free, automated crypto trading and more.

Tip #1 – Combining RSI Divergence with the Triangle Pattern

Triangle chart pattern is available in two variations, One is The ascending triangle pattern, which used as a reversal pattern in the downtrend. Another variation is the descending circle pattern that can be used as a reverse pattern when the market is in an upward direction. Let's take a look at the descending triangle pattern marked in the forex chart below. The market was in an uptrend and the price eventually started to slow. RSI is also a sign of divergence. These clues are indicative of the downfalls of this uptrend. Now , we can see that the uptrend that is currently in place is losing momentum , and as a as a result, the price ended up forming the descending triangle. This is a confirmation of that the reverse is happening. Now is the time to execute the trade short. Like the previous example we utilized the same techniques to break out to execute this trade too. Now let's look at the third strategy for gaining entry into trades. This time , we're going to match trend structure and RSI divergence. Let's learn how to trade RSI Divergence whenever trend structure changes. View the top rated online trading platform for site tips including automated trading bot, divergence trading forex, automated trading, RSI divergence, crypto backtesting, bot for crypto trading, automated forex trading, cryptocurrency trading, backtesting trading strategies, forex backtesting software free and more.

Tip #2 – Combining RSI Diversity with the Head and Shoulders Pattern

RSI divergence is a tool that forex traders use to detect market reversals. What happens if we mix RSI divergence and other reversal indicators like the Head pattern? It increases our odds of trading. Let's look at how to make trades more profitable by using RSI diversification along with the Head and Shoulders pattern. Related to: How to Trade the Head and Shoulders pattern in Forex. A Reversal Trading strategy. Before we think about a trade entry, we need to enjoy a positive market situation. We are looking for an inverse trend, therefore it is best to be in an environment that is trending. See the chart below. Follow the best best crypto trading platform for site info including RSI divergence, backtesting strategies, best forex trading platform, crypto trading bot, trading platforms, crypto backtesting, automated trading bot, crypto trading backtesting, trading platforms, forex backtesting and more.

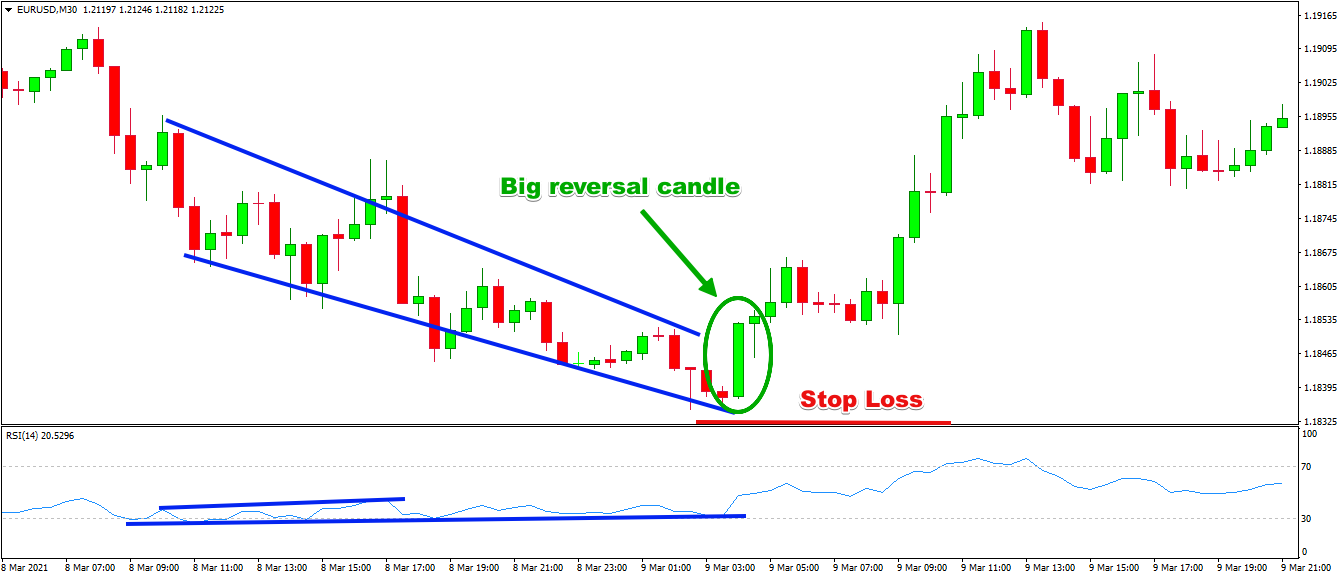

Tip #3 – Combining RSI Divergence with the Trend Structure

Trends are our best friend. If the market is trending, we need to be trading in the direction of the trend. This is how professionals teach us. The trend will eventually end but it won't last forever. So let's try to detect reversals early by observing trend structure and the RSI divergence. As we all know, the uptrend is creating higher highs while the downward trend creates lower lows. Look at the chart. It shows downtrend with series of lower lows and highs. Then, you can observe the RSI deviation (Red Line). The RSI makes higher lows, whereas price action creates them. What is this indicating? Even though the market creates low the RSI is doing the opposite thing this indicates ongoing downward trend is losing momentum, and we need to prepare for a reversal. Have a look at the best forex backtest software for more recommendations including trading platform crypto, best trading platform, automated forex trading, automated cryptocurrency trading, RSI divergence, forex backtesting, backtesting, software for automated trading, forex trading, automated cryptocurrency trading and more.

Tip #4 – Combining Rsi Divergence With The Double Top And Double Bottom

Double-bottom is a reversal chart that is formed after a long movement or an upward trend. The double top is formed when the price reaches an amount that is unbreakable. broken. After hitting that level, the price will retrace lower slightly but then return back to test the previous level again. If the price bounces back to that level, you will be in a double top. Take a look at the double top. In the double top below, you will see that two tops formed after a good move. The second one was not able to surpass the previous one. This is a strong sign that the buyers are struggling to go higher. The double bottom is built on the same principles, but with an alternative approach. We will apply the method of entry using breakouts. In this example we will sell the trade once the price drops below the trigger line. We recouped our profits after the price fell to below the trigger line. Quick Earnings. It is also possible to use the same strategies for trading the double bottom. Have a look at the following chart, which explains how you can trade RSI divergence in conjunction with double bottom.

This isn't the ideal trading strategy. There is no one trading strategy that is ideal. Also each trading strategy has losses. Even though we have a steady profit through this strategy, we also use tight risk management and a fast way to cut down our losses. This will enable us to cut down on drawdowns, and open the door to huge upside potential.